TraDove

ICO Investment — My View

Being new to the crypto world, I was looking to invest in upcoming ICO’s. Having heard about some past ICOs duping investors or not holding true to their promises I wanted to be extra sure before I can select and invest in any of the ICOs. I want to share my journey in how I prepared to DYOR for any of the ICO I will be investing in. This might be the most comprehensive guide on how one should study the ICO but I am sure this will help people out there to understand the work they need to put in to ensure they don’t land up a dud in their portfolio.

I did a fair bit of study on the current ICO market and the various parameters to check before putting your hard earned money into these ICOs. I want to share it among the wider community to help crypto newbies like me as well as learn from the ICO masters out there.

As they say there is nothing like DYOR.

Please note: I am not giving any financial advice. I am not a financial advisor. The comments mentioned here are my views and they in no form or factor should be treated as financial advice. DYOR !!!!

What is an ICO — Initial Coin Offering is called as an ICO. Using ICO crypto startups raise required capital to fund their product or services. You can see it somewhat similar to an IPO (initial public offering) in the securities market sans any regulation. One thing to note is that currently the Crypto market is not regulated and so are any ICOs that you will be participating in. This stage allows early investors to support the startup they believe in. Normally each ICO will go through the early private investors, pre-ICO and Crowd-sale cycles but might change. Given the current scenario of HOT ICO demand, many of the ICO get their hard-cap fulfilled at the private investment stage itself and does not reach crowd-sale which is a pity for small investors.

To invest in ICO you need to know what are the current or upcoming ICOs. You can find that out using our friendly google. There are multiple sites providing information on the current and upcoming ICO and their relative rating using their own benchmarking metrics. Again the methods and rating are subjective to each site and its necessary that you DYOR !!!!

The next step will be for you to understand what the ICO is about. You can understand that by referring to the ICO whitepaper. An ICO whitepaper is nothing but a business plan providing information on the startup and the product/service they are offering under the ICO. Most of the whitepaper will also provide information on the token metrics, the team as well as a high level roadmap. Reading and understanding the whitepaper will also bring forward any red flags around the project. It is necessary you dig dip on any of the red flags you come across before investing or rejecting the ICO.

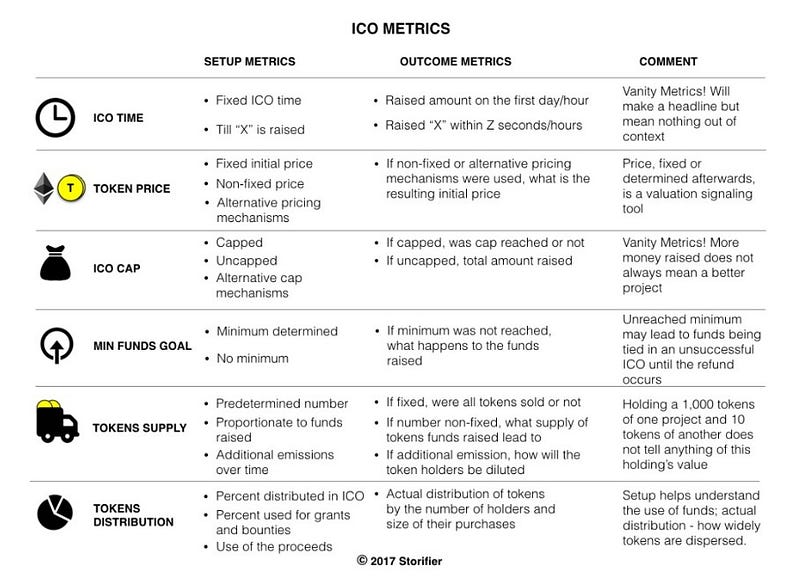

Some of the metrics that I think are important in assessing any ICO:

1. Product /Service — Try to understand if the product or service that is offered in the ICO is something which already exist or it is a new idea. Try to understand if the said product is another blockchain platform with better features or it is an Dapp on top of an existing blockchain. If it is a Dapp try to understand what blockchain is it built on and does it have any scaling problems. Try to gauge the scope of this product or service — What market will it impact, the target customer base for this product or service, what geographies will it operational in, are there any regulatory or licensing requirement for operating in the said geographies. The current competition if any and its strength, The usefulness of the idea, Is it something which you think can come to fruition in near future or requires some other technological advancement which it is dependent upon. There are some instances of ICO which basically did not had a new or innovating idea but was just raised to collect funds and as such they fizzled out once listed. Doing research on the above factors will give you a sense on the real need for the ICO and the business model that the company want to execute.

2. Company or Startup behind the ICO — Find our more on the company or startup that is raising the ICO. Find out how long they have been in the business. You need to understand the maturity of the company or startup. Find out where is the company based and does it require any special regulation to undertake the ICO and do they fulfill it. Find out where is the company based and the jurisdiction it is operated under. This will many a times dictate what the company can do, from whom they can take the funds etc. Also it is good to identify the legal structure of the company.

3. Team — Find who are there in the core team. Do the members bring in expertise in the area of the product or service that the ICO is bringing to the market. Find out more on their credentials and experience. Find out who are the advisors for the ICO. Find out on their credentials, have they advised on any of the past ICOs and how successful they have been. Find out the expertise or connection they bring to the table. You can make use of the social media platforms like Linkedin etc. to find out more on the team involved in the ICO including the advisors and investors. It’s necessary to establish the credibility of the team for able to part your funds to them and have the trust to execute on the project as mentioned in the whitepaper.

4. Token Metrics — Token metrics provide information on the token distribution and structure. The whitepaper should tell us about how much token are offered to the private investors, how many are offered during the pre-sale while how much the general public get. Most of the whitepaper will cover the token distribution during each of the phase. You also need to understand the softcap and hardcap for the ICO. Softcap — this is the minimum amount for the ICO to go ahead, while the hardcap to be raised gives you the maximum funds that the ICO plan to raise. Looking at these numbers you can make a judgement on if the particular ICO has a fair distribution and is raising enough capital for it to fulfill the objective stated in its Whitepaper. The token metrics will also tell you the total number of tokens for the ICO and the amount that is offered during the token generation event (TSE). Many of the ICO will offer only partial number of tokens for the sale while certain percentage of tokens will be allocated for the advisors and team. Check if the percentage of token reserved for advisors and team are on the higher side of the scale, find out if these tokens have any vesting period. No vesting period can lead to dumping of tokens as soon as the ICO is listed on the exchange. The token metrics is a strategic decision taken by the company for their ICO and your need to DYOR to understand how it fairs compared to the competition and current market as well as the product or service that the ICO aims to implement. Some of the ICO will have a low hard cap while others might have a large one but then you need to look at the target market and its demand to understand the spread. You also might want to look at the type of token that is on offer — Security Token, Currency Token, Utility token, Asset Token or Reputation/Reward token. Each of these tokens are fulfill a different aspect of ownership and should be appropriate to the service or product been implemented through the ICO.

5. Road Map — It is very important for the road map to be listed in the whitepaper. It is always preferred to have a detailed road map so we can understand on how and when the said product or service will be implemented. The road map can tell you the difficulty in achieving the goal and hence can provide better understanding on the appreciation on the coin value that you expect it to deliver.

The road map is a critical part of the ICO review as it will give you information if the said road map is something which is achievable and is realistic. Many of the ICO will have a very aggressive road map which is just put together to attract investors.

6. Working Product or Prototype — Do they have any working product? If not then what is the current status of their product. Is it in planning phase or design phase. Have they developed any prototype or proof of concept. If they have the product under development then what release version do they have — Is the product in beta or alpha version. If it is a platform then do they have a testnet released, when is the schedule for their mainnet release? Find out if they have a github repository and how many commits are done to it on a weekly or monthly basis.

Having a dormant github repository is an indication that the team is not actively working on it, which might mean that the team is yet to be fully established. This is a red flag which you need to be aware of.

7. Partnerships — What kind of partnership does the company or startup has or brings into the ecosystem. Try to understand how critical are these partnerships and is there too much dependencies on them for the product to be delivered. Is it a business or technology partnership. Are these partnerships formally signed or it is just a memorandum of understanding that is agreed.

This aspects around partnership are important to understand as you will come across ICO who do not have a firm partnership with bigger companies but nevertheless mention that in the ICO to give it credibility.

8. Social Media Interactions — Most of the ICO will be active on multiple social media channels. I feel twitter and Telegram are two of the most effective channels for investor interaction as well as to make the message reach out to wider audience. Ensure you sign up on to those social media channel if you are interested in the ICO. This will help you to keep abreast of the announcement as well as know the sentiment around the ICO from fellow investors.

The other channels which an ICO team can use is blog and forums. Bitcoin talk being the most important and well known forum where you can catchup on the discussion for any particular ICO. Do they have support forums where an investor can ask question. Get on to these channels to know more about the ICO and make a smart decision. These are big tools in your DYOR journey.

9. Others — There are other soft points which you can take note of. One of the most important point is the marketing aspect. The team needs to have a good PR to generate enough interest from the participant. Marketing can make a dud project shine and lack of it can make an allstar project go dud.

You also see the way the whitepaper is put together, does it look professional or a job done in haste. How about the website, does it look professional enough for you to hand over your trust and funds to them. Well this are not very critical but still important soft points which will make an impression on the investors.

I tried to summarize the points which I learnt from my DYOR journey on ICO selection. I hope this helps the other newbies here in the crypto world. I also welcome feedback and comments from the crypto masters out there. If there is any topic from the summarized points that anyone want to be expanded do let me know, and I will try my best to explain.

I used the above criteria to shortlist an ICO which I think is an A-Grader. It is in B2B space, has a working company with an allstar team. B2B space is unique and not challenged by many companies. Take a guess …… J its TRADOVE

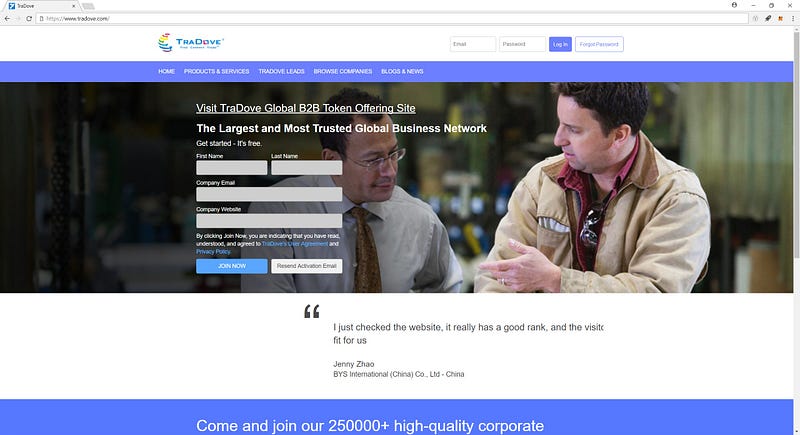

TraDove is US based organization dealing in B2B space.

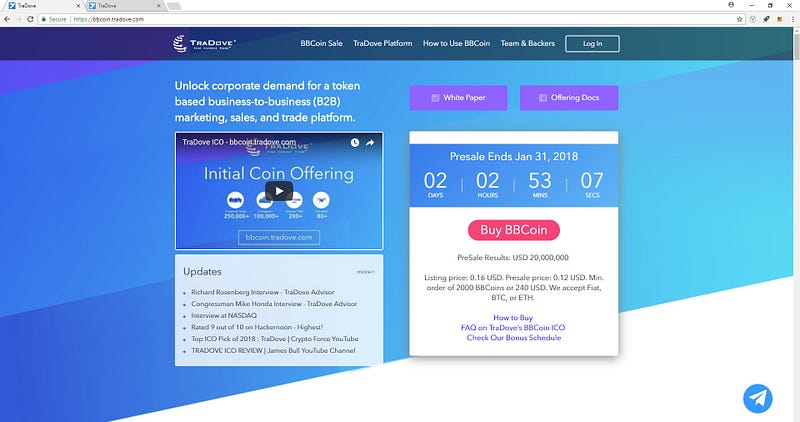

They have recently moving their service on to blockchain to address many challenges associated with B2B market. You can look at their whitepaper and register for pre-sale/crowdsale at https://bbcoin.tradove.com/ .

They have already raised USD 20 million under the pre-sale which is running till 31st Jan 2018.

If you think this ICO meets your all-star criteria, go ahead and register for it. You can use the below referral link if you wish so.

I will try to write another article to share my take away from this ICO and my reasons why I think this is worth your time and investment.

Do let me know your comments and feedback. Its valuable and will help us all learn on our crypto journey.

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1422011;sa=summary

Komentar

Posting Komentar