HyperQuant Blockchain is a new standard for automated investment

HyperQuant Blockchain is a new standard for automated investment

What is HyperQuant?

HyperQuant Blockchain is a new standard for automated investment.

This makes the investment process simpler and transparent for all market participants - from small investors to hedge funds and professional capital managers.

This is an investment process in which the user sets the initial preference (appropriate risk level, supported coins and crypto exchange, etc.), while the AI-controlled automated system makes all the procedures further.

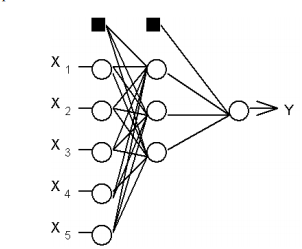

AI enhanced technology development is becoming increasingly common in everyday life. Artificial neural networks are the basis of the AI algorithm. The principle of neural network creation, that all operations built around, is relatively simple. In machine learning - artificial neural networks form a family of statistical education models, made similar to biological neural networks (the central nervous system of animals, especially - the brain). In their essence this is a communication system that transfers messages to each other and has a digital weight. This makes the neural network adaptable to input and able to learn. Therefore the system based on the neural network is constantly adapting to changing conditions in real time.

An example of a neural network model, based on a three-layer perceptron.

The main disadvantages and problems with AI Education -based trades are wrong or re-optimization. The market is a fully open system with an ever-changing quantitative and qualitative membership of its participants. Changes that occur affect the market growth, fluctuations, volatility, and changes in exchange rates. Developers often try to include many unrelated and unformatted entries into the AI, which is a serious error. Trained nerve tissues, for example, to recognize faces on photographs, are not suitable for exchange trades - and vice versa.

Exchange statistics show that 80% of accounts associated with the use of neural networks - are set to zero in the first year after manufacture.

Lack or incorrect risk management. Survival in the market is directly linked to the ability to control risk. Only financial and risk management experts allow traders to live longer than the general turbulence period. AI, which is able to forecast market changes with 90% accuracy, can make a series of 10 to 100 losses by making consecutive agreements. Even by accurately predicting the direction of change and future price levels (an important indicator is the price level, not the price) - it is impossible to accurately determine how the price changes from the old (point A on the graph) to the new one (point B).

3. BlackBox. Few understand that by teaching neural networks - a merchant receives a black box. The end product is a sealed construction with an unintelligible decision-making algorithm even for the trader. With an unfavorable environment and significant investment losses - traders will not be able to accurately locate the reason for the damage.

HyperQuant philosophy.

Quantitative hedge funds are similar to private clubs, which require a high financial level to enter. There is a big reason for the exclusivity. Contrary to ordinary funds - the quant always strives to achieve market neutrality with the strategy portfolio, thereby reducing the impact of the dynamics of market movements. This allows investors not to worry about black swans and long-term investment risks.

Lack or incorrect risk management. Survival in the market is directly linked to the ability to control risk. Only financial and risk management experts allow traders to live longer than the general turbulence period. AI, which is able to forecast market changes with 90% accuracy, can make a series of 10 to 100 losses by making consecutive agreements. Even by accurately predicting the direction of change and future price levels (an important indicator is the price level, not the price) - it is impossible to accurately determine how the price changes from the old (point A on the graph) to the new one (point B).

AI, trained only to predict the outcome, can easily lose all the funds invested during the independent education period.

3. BlackBox. Few understand that by teaching neural networks - a merchant receives a black box. The end product is a sealed construction with an unintelligible decision-making algorithm even for the trader. With an unfavorable environment and significant investment losses - traders will not be able to accurately locate the reason for the damage.

HyperQuant philosophy.

Quantitative hedge funds are similar to private clubs, which require a high financial level to enter. There is a big reason for the exclusivity. Contrary to ordinary funds - the quant always strives to achieve market neutrality with the strategy portfolio, thereby reducing the impact of the dynamics of market movements. This allows investors not to worry about black swans and long-term investment risks.

Our philosophy is shaped around the departure from market risk by creating the right risk management structure, balancing strategy and using wide diversification. That's why HyperQuant uses AI not only to predict the market but to make the best investment choice on a thorough classification. The core of our platform is the neural network - the mechanism of continuous assessment of learning. The relentless development comes with platform growth and the last elemental improvement leads to an increase in the information received by neural networks. This, in turn, makes education of neural networks more efficient. It also helps to quickly adjust the newly introduced elements in the system.

How it works.

A complex ranking system is a great way to develop a financial platform. Ranking is the instrument's potential over a period of time depending on a combination of quantitative and qualitative characteristics, expressed in the final digital sign. Ratings can be calculated with the help of different statistical methods. In the world's financial system, the rankings consist of independent rating agencies - Moody's, Standard and Poor's, and Fitch Ratings. They are used to evaluate the solvency of a company's credit. By using these assessments, potential investors can understand whether they should buy company liabilities and how reliable these investments are.

AI establishes an investment rating based on its own analysis system. This can be shown to users with understandable graphical methods. The success of an investment is analyzed using a variety of criteria, beyond the simple method of risk-profitability evaluation.

If there is a down rating sign - the neural network has a built-in warning system. If the user performs risky actions, declining trading results or diversifying portfolio elements is not high enough - the system displays a warning to the user. Similarly, traffic lights vary depending on how critical the situation is.In a worst-case scenario the system can block any access to a problem element, thus avoiding a full investment loss.

HyperQuant is a smart home for predictive systems based on AI.

When developing the AI system, prospective entrepreneurs rarely consider the potential difficulties that arise in the real market, especially when their systems need to be improved. The algorithmic trade vital requires a properly built infrastructure to facilitate access to the exchange system. This affects the speed at which online information is received and the ordering of the market order flow into the exchange.

HyperQuant offers a combined interface to receive and collect information collected from all cryptocurrency exchanges.

In addition, the demand transfer protocol, developed by HyperQuant (HQ-FOT protocol - partner of the FIX / FAST protocol), allows to speed up market order transfers in the exchange system up to 10 times.

HyperQuant platforms automatically balance and sort out the order flow in crypto-exchange so as to stabilize the pressure on them.

The citing strategy employed allows to increase the exchange position over time without causing sudden rate fluctuations.

With this operation, offering the HyperQuant platform with the main activity load, enables the central AI to focus only on its main function - transferring beneficial signals to users.

AI-based advanced technology is growing rapidly and expanding lately. It will be the next "Big Thing", a new trillion dollar industry. But here at HyperQuant we not only develop smart algorithms or other neural networks, we are building a large, future home platform for thousands of AI-based systems.

How it works.

A complex ranking system is a great way to develop a financial platform. Ranking is the instrument's potential over a period of time depending on a combination of quantitative and qualitative characteristics, expressed in the final digital sign. Ratings can be calculated with the help of different statistical methods. In the world's financial system, the rankings consist of independent rating agencies - Moody's, Standard and Poor's, and Fitch Ratings. They are used to evaluate the solvency of a company's credit. By using these assessments, potential investors can understand whether they should buy company liabilities and how reliable these investments are.

AI establishes an investment rating based on its own analysis system. This can be shown to users with understandable graphical methods. The success of an investment is analyzed using a variety of criteria, beyond the simple method of risk-profitability evaluation.

A diagram detailing the process of data required for the development of a risk management system model.

If there is a down rating sign - the neural network has a built-in warning system. If the user performs risky actions, declining trading results or diversifying portfolio elements is not high enough - the system displays a warning to the user. Similarly, traffic lights vary depending on how critical the situation is.In a worst-case scenario the system can block any access to a problem element, thus avoiding a full investment loss.

HyperQuant is a smart home for predictive systems based on AI.

When developing the AI system, prospective entrepreneurs rarely consider the potential difficulties that arise in the real market, especially when their systems need to be improved. The algorithmic trade vital requires a properly built infrastructure to facilitate access to the exchange system. This affects the speed at which online information is received and the ordering of the market order flow into the exchange.

HyperQuant offers a combined interface to receive and collect information collected from all cryptocurrency exchanges.

In addition, the demand transfer protocol, developed by HyperQuant (HQ-FOT protocol - partner of the FIX / FAST protocol), allows to speed up market order transfers in the exchange system up to 10 times.

HyperQuant platforms automatically balance and sort out the order flow in crypto-exchange so as to stabilize the pressure on them.

The citing strategy employed allows to increase the exchange position over time without causing sudden rate fluctuations.

With this operation, offering the HyperQuant platform with the main activity load, enables the central AI to focus only on its main function - transferring beneficial signals to users.

AI-based advanced technology is growing rapidly and expanding lately. It will be the next "Big Thing", a new trillion dollar industry. But here at HyperQuant we not only develop smart algorithms or other neural networks, we are building a large, future home platform for thousands of AI-based systems.

HyperQuant Social Media

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2024269;sa=summary

Komentar

Posting Komentar