KYC.LEGAL

Overview of the ICO project KYC.LEGAL

Hello ! Today we, on the agenda, have an interesting project KYC.LEGAL !

Let's look at this ICO in more detail.

First of all, what is KYC?

KYC = Know Your Customer is the term of banking and exchange regulation for financial institutions and bookmakers, as well as other companies working with private money, meaning that they must identify and establish the identity of the counterparty before conducting a financial transaction.

What services do I use KYC?

Exchanges, crypto- exchanges, brokerage offices, banks, funds, online loans and so on.

Especially, it is worth highlighting ICO , where recently the tendency to use KYC in the conduct of a tokenail has become more frequent. Also, KYC is needed to provide services such as online orders for prescription drugs. Or confirmation of the age of the buyer, say, for the purchase of alcohol and tobacco. In general, any services that require verification of identity and identification.

Short introduction:

KYC.Legal is a new unique service that allows you to verify and identify the user, which prevents possible fraud: no one can use someone else's name for personal gain, for example - to get paid services. To protect and validate the data, the well-known Blockchain technology is used.

What do we have now in the field of identification?

And now we have a lot of problems: from the fact that there are a lot of unnecessary intermediaries in this sphere, and the identification process itself is confusing and to the point that the data are vulnerable to hacker attacks.

Ps The fact that there is a lot of commissions and speed leaves much to be desired - you can not even say :)

Pros for service and for users

For the user:

· Personal information is protected by encryption and biometric data

· Data is stored on the user's device

· The user himself chooses what information to provide to the service

· Confirmation of documents using a digital signature

· Personal information is protected by encryption and biometric data

· Data is stored on the user's device

· The user himself chooses what information to provide to the service

· Confirmation of documents using a digital signature

For services:

· Reliable information about the user

· No fake or duplicate user profiles

· KYC (know your customer) compliance

· Ecosystem for interaction of services with customers

· Reliable information about the user

· No fake or duplicate user profiles

· KYC (know your customer) compliance

· Ecosystem for interaction of services with customers

Both systems, both users and services, benefit from the use of the system.

How does it all work? And how is it arranged?

On the project site there is a video briefly describing the process of passing the identification:

Let's describe the process:

First, the user enters his identification data into the system. You can ask - what prevents a user (theoretically a fraudster) from entering other people's data?

And here is the answer: after this the Agent leaves to the client, who must confirm that the person did not lie and registered his personal data. The cost of identification is planned to be set to $ 50, of which $ 5-25 will be received by the agent in the form of commissions. At the same time, it will be the same person as you, he is not an employee of any outside organization.

The platform will use all relevant existing services on the market, which are related to data validation, including such as Authorities, Police and other agencies.

How can an ordinary person get access to a service?

Very simple! You need to download a mobile application (available in the appstore and playmarket), where you first enter your personal information. This is a stage of independent verification. To get full verification, you need to complete 2 part of the task: to meet with an agent who will make sure of the reality of your data. It remains only to wait:

After passing the 2-step verification, the user will receive a notification of verification. The information will be sent to all structures with which the project interacts: Exchanges, Banks, Insurance campaigns, as well as any other structures that require identification to provide their services.

Identification takes place in 2 stages: independent verification and full verification (meeting with the agent)

Such a model can be compared with the identification (when signing a contract) at Tinkoff Bank.

Possible disadvantages of this solution

Each person should consciously approach the use of this service:

Imagine a situation that a person identified in the system has a delay in mortgaging in one of the banks, which is also included in KYC.Legal. The user is automatically added to the black list, which will be distributed to all organizations that are part of the system. In the future, this may entail a denial of service or provision of any services by organizations that are free to see the blacklists of KYC.Legal.

Here you can draw an analogy from the real world: the examination of an application for a loan to a person who had previously served in other banks / took out loans. The so-called Credit Conveyor, based on many factors, makes a decision - a trustworthy client or not. At the same time, this information is available for any banks that have concluded an agreement with this system.

Who invented all this?

Daniel Rausov is the founder of the project KYC.LEGAL. He is also the founder of a number of companies in the field of IT and B2B

Sergey Bikrenev is the owner of the company EUU (European Legal Service)

About a year ago the team worked on creating a product for the financial market, for microcrediting. I wanted to make the process as simple as possible, fast and reliable. It turned out that all the solutions offered on the market to verify the identity of customers are complex and difficult to apply.

KYC.Legal is a solution focused exclusively on customer identity verification.

Our slogan is fast and simple. Quickly and simply get KYC.

Our solution is focused solely on confirming the identity of the client, our slogan is Quick and Simple. Quickly and simply get KYC. Verification of the user in us takes less than 45 minutes - from the time of installation of the application and registration in the system before the arrival of the agent. Such a decision will be relevant for a variety of business areas, not just for lenders.

Full project team

Separately it is worth noting that the entire team has profiles on LinkedIn. This definitely pleases.

Project road map

Roadmap for Marketing and Attraction agents

Tokensail details and distribution of tokens

KYC - ERC20 token

1KYC = 1USD

KYC.LEGAL will issue 35 million KYC (ERC20 token) at a price of $ 1 during the normal period of the ICO. The KYC.LEGAL project team will also issue an additional 20% of the already released number of tokens - 15% of which will be retained by the project team, and 5% will cover ICO costs, which is quite logical, considering recent events related to overloading of the block air of for a burst of interest in cryptokitties.

Let's take a look at the distribution of funds:

$ 2.5 million - Discounts for partner funds

$ 3.5 million - Referral payments

$ 1 million - Team

salaries and overheads $ 1 million -Traits on advertising technology

$ 3 million - Spending on marketing and monthly participation in the Road Show

$ 25 million - Funding of free provision of identification services for the first 1,000,000 users

($ 25 for a certified agent, the remaining half must be covered by active token holders

in exchange for promoting their stacks and services).

$ 3.5 million - Referral payments

$ 1 million - Team

salaries and overheads $ 1 million -Traits on advertising technology

$ 3 million - Spending on marketing and monthly participation in the Road Show

$ 25 million - Funding of free provision of identification services for the first 1,000,000 users

($ 25 for a certified agent, the remaining half must be covered by active token holders

in exchange for promoting their stacks and services).

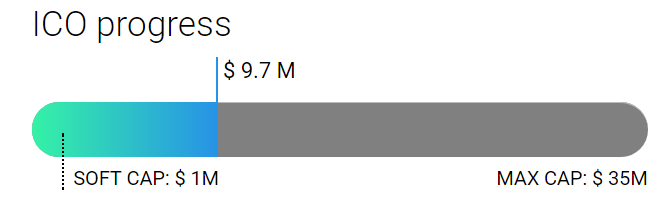

Current fees (as of 12/20/2017)

Collected almost $ 10,000,000! Very good result.

The sale of tokens takes place in 14 stages. With each stage, the discount for buying tokens is reduced. At the moment, it is 46%:

Official groups and project channels

Official Web-Site | Official Blog | Facebook | Twitter | Telegram Official (eng) | Telegram Official (rus)

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1422011;sa=summary

Komentar

Posting Komentar